- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

Tesla Q2 2025 Earnings Preview: Will a Catalyst Spark the Next Big Trend?

Tesla remains a favourite among CFD traders due to its:

• Elevated volatility

• Deep liquidity

• Broad high–low daily ranges

• Frequent state of trend Add Elon Musk’s constant media exposure and Tesla’s central role in the EV and AI narrative, and it's no surprise this stock stays at the top of watchlists.

The Technical Setup: Waiting for a Breakout

Currently, Tesla’s share price is consolidating between $280 and $360, suggesting the need for a stronger macro or company-specific catalyst to drive a breakout. Sentiment remains fragile—partly due to Elon Musk’s growing political ambitions, which may be diverting attention from operations, and partly due to speculation around how a second Trump term might affect Tesla’s regulatory environment.

EV Tax Credits & Demand Headwinds

We’ve recently learned that Tesla will lose eligibility for U.S. federal EV tax credits—a potential demand headwind at a time when delivery numbers are already softening. Tesla’s Q2 2025 deliveries came in at 384,000 units—a "better-than-feared" result, but still:

• –13% vs Q2 2024

• –18% vs Q2 2023

This trend is expected to be reflected in the upcoming revenue and margin print.

Street Expectations for Q2 2025

Metric Expectation

Revenue $22.86 billion (–10.3% YoY / +18.2% QoQ)

Net Income $1.54 billion Free Cash Flow $577 million

FY2025 Delivery Guide 1.65 million units ASP (avg selling price) ~$39,351

FY2025 EPS $1.84 FY2026 EPS $2.76

FY2025 Revenue $95.59 billion

Investors will be watching closely for any adjustment to guidance, especially delivery volumes and margin trends. Deviations from these consensus benchmarks could spark significant price action.

Volatility: Historical Context & Options Pricing

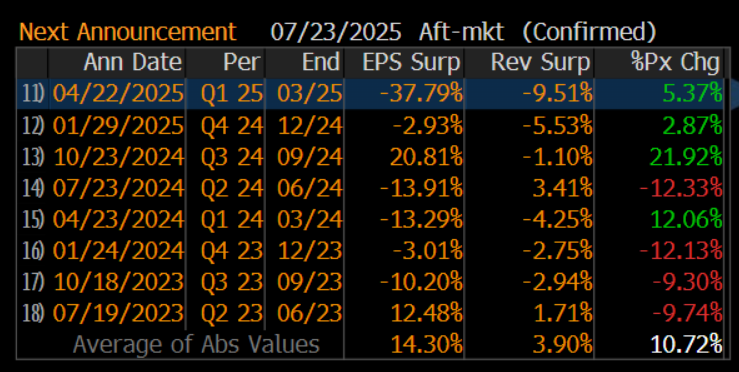

Tesla shares are historically very reactive to earnings: • Average absolute move of ±10.7% over the last 8 quarterly earnings days • Current options pricing implies a ±6.9% move on this Q2 result This confirms the setup as a high-impact event for short-term traders and one worth preparing for—whether via directional exposure, straddles, or volatility-based strategies.

Valuation Gap Highlights Market Uncertainty

There’s no shortage of debate about Tesla’s fair value:

• J.P. Morgan: $115 12-month price target

• Wedbush: $500 price target This enormous dispersion in analyst price targets illustrates just how polarising Tesla remains. Differing assumptions on growth, margins, AI, robotaxis, and Musk’s roadmap are driving vastly different models—and traders should be prepared for volatility that reflects this uncertainty.

Will We Get a New Trend Catalyst?

Tesla is coiled in a range. While fundamental sentiment is mixed, the stage is set for a directional move—should the company provide a clear and compelling outlook that exceeds (or falls short of) the Street’s expectations.

This is one to have on the radar—and a key opportunity for traders looking to catch the next trend in one of the market’s most liquid and volatile names.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.