- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

Sentiment Sours As US Exceptionalism Looks More Fragile

WHERE WE STAND – After a week where markets did next-to-nothing, most – including your scribe – were expecting a subdued Friday to wrap up the trading week. That, though, was far from what ‘Mr Market’ decided to deliver.

Stocks took a lurch lower, just as most in London were mulling whether it was time to head to the pub, in a sell-off that then took hold, and intensified into the NY close – the S&P sliding a chunky 1.7%, the Nasdaq 100 shedding over 2%, the former losing ground for the second day in a row, having set a fresh record close on Wednesday.

In all honesty, it’s tough to pin the souring in sentiment on any particular catalyst. Yes, Friday’s US economic data was softer than expected, though plenty of caveats must apply.

The ‘flash’ reading of S&P Global’s services PMI pointed to the sector having unexpectedly contracted on the month, as the index slumped to 49.7, its lowest level in more than 2 years. That said, the bulk of this decline was due to “uncertainty related to federal government policies”, which should be overcome in short order, while the more widely-watched ISM surveys, due at the start of next month, are a much more accurate gauge of US activity, in my view.

The day also brought revisions to the UMich consumer sentiment print, which fell to 64.7, from a preliminary estimate of 67.8. The indicator, though, is of almost no use whatsoever these days, as the survey has become far too politically polarised to offer much by way of signal. For context, sentiment among GOP voters held steady at 86.7, while among Democrat voters it tumbled from 65.0 to 51.3. If anyone thinks there’s any useful intelligence to extract from that, then I have a bridge to sell you.

Still, on the whole, I guess these prints, setting aside those caveats, do point to a few more dents beginning to emerge in the ‘US exceptionalism’ narrative, particularly after soft retail sales figures a week ago, and dismal guidance from Walmart last Thursday.

I’d still be comfortable buying the equity dip here, though – fundamentally, the economy remains solid, and the labour market tight, with these recent developments largely being short-term headwinds which should blow over. Fundamentally, economic growth remains solid, and earnings growth also continues at a healthy clip. Sprinkle on top the FOMC floating the idea of pausing QT in the second quarter, thus halting the ongoing liquidity drain, and I’m still confident that the path of least resistance leads to the upside. Maybe, though, adopting a more defensive bias at a sector level might be appropriate for the time being. Nvidia (NVDA) earnings this week now stand as the next key event for equity participants to navigate.

Elsewhere, market moves were pretty much in keeping with the ‘classic’ risk-off playbook; a firmer USD, and gains across the Treasury curve. Gold was a touch softer though, bucking this trend somewhat, in a move that smacked of profit taking as the yellow metal remains tantalisingly close to the $3,000/oz mark. A test of that figure still feels like a question of ‘when’ not ‘if’.

In terms of the FX space, though, staying long USD continues to make a lot of sense to me. Even if some cracks could be starting to emerge within the US economy – and, I think it’s far too early to say that with any confidence for now – the backdrop Stateside is still one that is vastly more positive than seen anywhere else in DM. In short, the US, and the USD, will likely remain the ‘best of a bad bunch’, even if momentum does begin to wane a touch. Dismal eurozone, and UK, PMIs on Friday help to evidence this point, with the composite output gauges in both cases now within a whisker of dipping back below the 50 mark.

Of course, as the new trading week gets underway, the big focus for FX participants is the results of Sunday’s German federal elections.

The result of said elections is, by and large, in line with market expectations, with the next German government set to be headed by the CDU/CSU’s Merz, with the ‘Union’ being joined in government by the SPD, forming a so-called ‘Grand Coalition’. The relatively muted reaction in the EUR to the election results shows how such a result was well-discounted by market participants prior to the vote.

Focus now, naturally, turns to ensuring that the aforementioned coalition does indeed come to pass, which might take until Easter, as well as the matter of debt brake reform. On this front, the key focus will be whether the AfD, and other parties opposed to said measures, obtain a ‘blocking minority’ in the Bundestag to prevent such reform, which requires a 2/3rds majority in parliament. Such a block would likely be greeted poorly by market participants, given hopes that fiscal stimulus, and a looser overall fiscal stance, would help to turn around the ailing German economy.

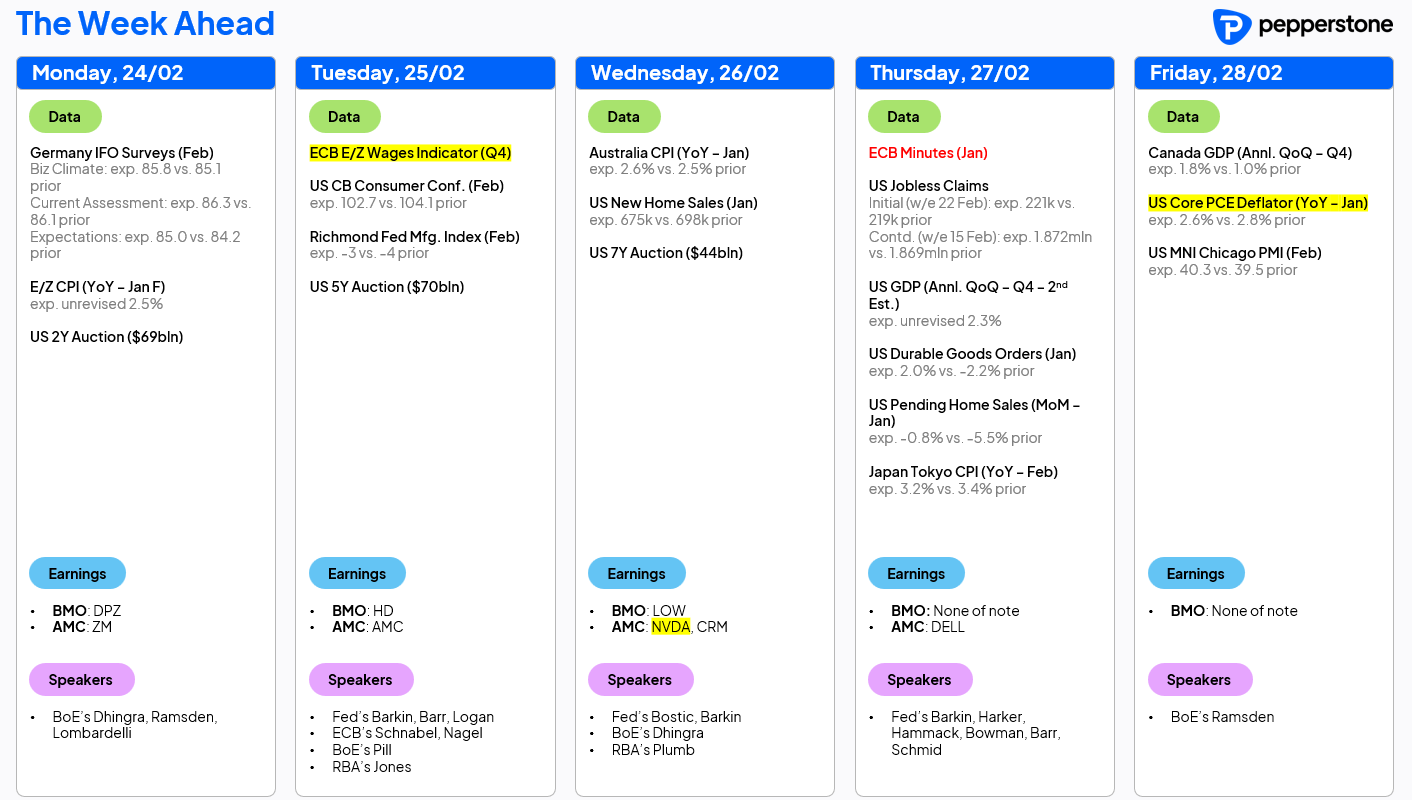

LOOK AHEAD – The data docket for the week ahead is, again, rather uninspiring, though fallout from the aforementioned German election results should provide some interest throughout today, at least.

Looking further ahead, earnings from Nvidia (NVDA) after the close on Wednesday are the most notable risk event for participants to navigate, with focus likely to fall on NVDA’s guidance as to whether the current staggering pace of revenue growth, and wide margins, can be maintained. Given how DeepSeek’s emergence has made risks around the AI theme much more two-sided, any disappointments from the chipmaker are likely to be severely punished by market participants. Options, incidentally, price +/- 7.7% in the 24 hours following the earnings report.

Elsewhere, the latest eurozone wages, and US PCE inflation, figures highlight an otherwise barren data docket, though another deluge of central bank speakers may somewhat fill the data void. That said, a chunky week of US supply does await, with 2-, 5-, and 7-year auctions on the slate.

The full week ahead calendar graphic is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.