Analysis

Trader thoughts - a market reminiscent of 2020!

– Nvidia's forecast clearly impacting – the VWAP and point of control (for those using market profile) came in at 4148, which equates to 4146 on our US500 index – so this is the level to watch near-term as this is where the bulk of the volume was transacted on the session.

Risk-wise, high beta stocks have been killing it of late, and low-risk, defensive plays have been shunned – maybe a refection that US data has improved – or at least been less bad – and some are positioning for the ‘peak inflation’ narrative, and we should see that in the headline US CPI print (tomorrow 22:30 AEST) is expected to slow to a 0.2% MoM pace (from 1.3%), which takes the year-on-year clip to an expected 8.7% - given most of the decline is expected to come down to falls in gasoline, one questions if we are better looking at core CPI, which is expected to rise 0.5% MoM

We know US inflation typically beats expectations – since August 2020 only 3 prints have been below the consensus – so, the balance of probabilities suggests an upside beat, but for me, I would look at the headline MoM clip and if we get a negative print – something that no economists are currently forecasting, then that is where we could see risk really.

QE is back…for now

If I look at the liability side of the Fed’s balance sheet, we can see commercial banks' excess reserves held with the Fed have been rising and this is offsetting any reduction in the $8.439t of securities held on the asset side of the balance sheet through QT - in effect, the market has seen net liquidity pushed into the financial system, or what some would see as quantitative easing (QE)!

For the high beta plays – the no earnings, liquidity beneficiaries have been inspired by a combination of better system liquidity, better economic data and anticipation of peak inflation – add in your typical flow (hedging, vol targeting, short covering) and we see the results are there for all to see.

Crypto is starting to look like turning into a real momentum move, notably Ethereum is ominously poised to breakout – tactically, buying now ahead of US CPI is aggressive and as we often see in momentum trades the risk is closing out for a small loss – however, a weak CPI print and the crypto scene should work well.

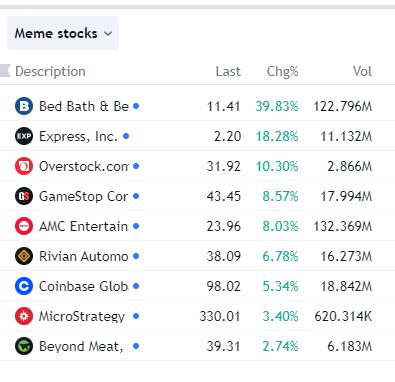

It's no surprise then that meme names are off to the races, with some huge moves in high short interest plays – these are the ultimate liquidity beneficiaries – BBBY, GME, and AMC were the most discussed tickers in WallStreetBets forums and were trending in Stocktwits. There was big buying of call options, notably in AMC (closed $23.96), with a chunky 77k contracts traded on the day in the $30 calls expiring Friday – some big bullish bets taking place here and a belief these names push higher.

It's all scarily reminiscent of 2020!

Can it last? The US CPI print will hold the answer near term.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.