- English

- 中文版

A traders week ahead playbook - a historic week in the making

It’s incredible to think how fast the marriage of the two rivals has gone down.

The focus shifts to how UBS’s equity and bonds trade in the session ahead and if they can convince CS clients and depositors to stick around - especially given UBS is halting its buy-back.

The initial move in markets to the news has been to buy risk and we see EU equity futures +1.2%, NAS100 +0.5%, AUD +0.8% and UST 2 yr +17bp.

We also look to see how the wider EU banks trade - EU banks are quite different from US banks; they didn’t see the same sort of rapid deposit growth as US banks post-pandemic and had a greater propensity to put depositors' cash on the ECB’s balance sheet – unlike US banks who bought a load of high-quality assets for the coupon income. But they did so at near-zero yields and as the Fed hiked rates these assets fell dramatically in value and by far more than the banks were getting from the interest (i.e. the fixed coupon payment).

Credit Suisse was the problem in Europe – so price action in the wider EU banks could offer a view on whether the tie-up with UBS is seen as reducing a wider systemic issue – we watch the EUSTX50, GER40 and UK100 this week. As mentioned, we are already seeing EU equity rally, but can it be sustained?

Let us now focus on the US banks – while we watch moves in the US 2yr Treasuries, USD, gold, and indices CFDs, especially as we navigate a very important FOMC meeting, I suspect US bank equity moves are the central focus and really the big issue at hand this week.

The major concern I see in the US bank space is that the FDIC (https://www.fdic.gov/resources/deposit-insurance/) stipulated last week that they will cover non-insured deposits held with a bank over $250k ($250k was always the limit deposits would be insured up to in case of a failed bank). SVB Bank’s full deposit base was told they would be made whole, but the market quickly understood that it wasn’t a banking-wide blanket guarantee – it was an implicit guarantee, and each future bank that failed will be considered on a case-by-case basis.

To have a wholesale guarantee covering EVERY BANK DEPOSIT needs congressional sign-off and that is very unlikely - this is key to market sentiment. We also heard last week that the Fed had set up a new credit/liquidity facility and enhanced existing ones for banks that needed liquidity – the idea here was that banks could get capital from the Fed and pledge assets they hold on their balance sheet (USTs, mortgages etc) as collateral and to get capital for a predefined period at the ‘par’ value (rather than the more distressed price they are trading now – let’s say 80c in the $1.

Given we’ve seen the Fed’s balance sheet increase by $300b last week as mid & smaller banks took them up on these loans, this shows how much they needed the capital (bad) but some see this as a form of QE (Quantitative Easing) and hence we’ve seen crypto CFD and gold rally strongly and eyeing all-time highs.

Essentially, it’s not QE, but it is positive for risk assets because it means if we do see further deposit outflows banks won’t now need to sell assets for what would be a loss – which was one of the major issues with SVB Bank.

As said, gold rallied hard (+3.6%) on Friday and the USD fell…. gold printed new ATHs in AUD, GBP, and JPY terms – Gold futures are oscillating around $2k and while we’re seeing some selling today we eye an all-time high (ATH) of $2075 in USD terms.

There was talk on Friday that “dozens” of other banks may fail soon as depositors take their cash and run. In fact, the WSJ said 186 banks are facing the same issues/pressure as SVB bank - this has the market on edge, and they crave an even bigger response.

We’re hearing over the weekend that a group of 110 US banks is requesting full FDIC insurance for all deposits regardless of the amount – this would give depositors absolute peace of mind not to pull capital from the bank and place the funds in ultra-safe money market funds. These funds flow are opaque but incredibly important.

For perspective, if any bank fails from here and the FDIC does not make all depositors whole the market will take this as a systematic event, regardless of the bank – it will rock the markets in a massive way – which is why it won’t happen at this point.

Case in point, and this is very important - Late last week we heard First Republic Bank (FRC) had been given a $30b injection of deposits from 11 of the biggest US banks. A private market response is old school and shows the banking industry is working together. The globally systemic banks looking after the smaller banks is 100% designed this liquidity to show their faith in the FDICs deposit insurance.

Why? These banks are all non-secured creditors for FRC and, in theory, could lose it all if First Republic go under and the FDIC doesn’t pay out.

Unfortunately, on Friday shareholders didn’t take heart on this incredible action and sold FRC’s equity down 33% and the share price now eyes new lows – clearly, not a great look and this resonated through US equity markets. Deposit holders may get it all back, but equity holders won't…the KRE ETF CFD (S&P regional bank ETF CFD) closed -6%.

We watch to see if the banks turn around this week – that could drive broad market sentiment, although the trade at present is to rotate into big tech.

Warren Buffett held talks with a number of regional bank CEOs in the last 2 days – Buffett did this well in 2008 by taking a stake in Goldman and in 2011 in BoA – he is the kingmaker in times like this – he has an incredible war chest of cash and will pick up distressed assets all day.

Buffett won’t buy the float of these banks obviously but taking stakes could send a message of confidence to equity investors and maybe depositors – we listen for news flow and headlines on this through the week – will it be taken as a positive for markets?

We’ve also seen six of the big central banks announce USD swap lines – this is getting some attention with some concern as to what it represents – my view is this is more preventative and designed to get in front of any issues with USD funding. It is a positive and proactive measure, and we should see measures of USD funding reduce.

Last week was a defining week - historic in many ways – this week with the FOMC and BoE in play we should get more answers to help us price risk more effectively- that said, there is still much that can go wrong for risk, and it could get a little wild.

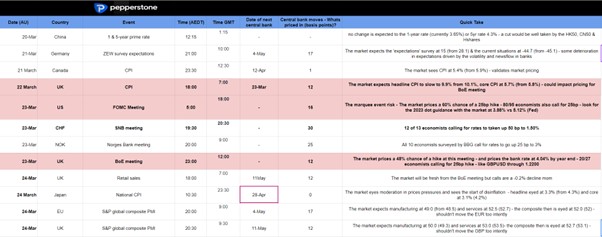

Here is the calendar of marquee events I have on my radar and comments on how they may play out.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.