How the 2025 Australian Federal Election Could Move the ASX200 and AUD

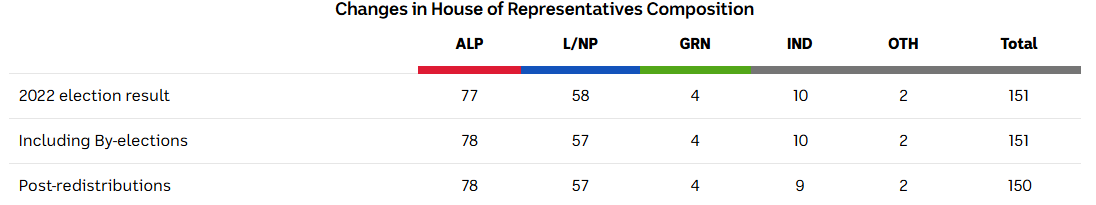

The betting markets have ALP favoured to win the election, although, they are widely expected to lose seats at this election, a trend seen from all first-term governments since 1966, with the prediction/betting markets pricing an equal probability that the ALP pull between 71-75 seats (hung parliament) or between 76-80 seats (an outright win). The Coalition is expected to build on the 55 seats obtained in the 2022 election, with the betting markets seeing a total of between 66-70 seats as the most probable outcome. The Independents are expected to hold 10 seats, with the Greens maintaining 3 or 4 seats.

Early voting opens on 22 April, and while we may not get the same level of early votes cast in 2022 (close to 50% of all voters cast an early vote largely because we were coming out of Covid), a high percentage of early votes may boost the accuracy of the polls before 3 May and offer market players a reasonable guide on how to position exposures and portfolios through the election.

Naturally, many are cynical of polling accuracy, but in the 2022 election, polling on a two-party preferred basis proved highly accurate by historical and international standards.

What do the Markets Want to See?

The key issues for Australian voter’s centre on the cost of living, housing affordability, healthcare, and economic/labour market stability.

Both domestic and international investors – at a high level - want a continuation of policy and/or an outcome that facilitates the smooth passing of a party’s legislative agenda. They want an outcome that offers the fewest surprises, making the job of pricing risk, economics, and earnings more efficient. After three years of governance, ‘the market’ has become comfortable with the level of fiscal spending laid out by Treasurer Jim Chalmers, as they have with Australia’s ongoing relationship with the Trump administration and with China.

While Trump’s tariff and trade policy is not a core election issue for Australian voters, it is for markets, so any election outcome that increases uncertainty around Australia’s ongoing diplomatic position could lead to selling of ASX200 equities.

Any election outcome that leads to an increased perception of political gridlock and lengthy negotiations for passing the legislative agenda could also increase ASX200 equity volatility. A hung parliament is the risk here, and we discuss the scenarios that could affect Australian equity and the AUD below.

However, the worst scenario for Aussie markets would be the outcome that increases the risk that we could see a sizeable change in the level of future government spending. In the case that we see a hit to spending – such as we saw in 2010 under the Gillard-led minority govt, which seems unlikely, but it would require the RBA to do more of the heavy lifting should we see increased fragility in the economy.

With the private sector recording such aminic growth, and the economy having just come out of a per capita recession, govt spending does matter for the economy, at least in the public sector.

The Prospect for Gapping Risk

We should learn of the election result by Sunday (4 May) and whether one party achieves an outright win, or we see a hung parliament. By way of a loose risk management exercise to consider the potential for movement and gapping risk in the AUS200, AUD and govt bonds, we break down the scenarios seen as most probable in the betting markets and the possible market reaction.

Reviewing Expected Election Volatility

Through Options Pricing The best way to quantify expected movement for a market by a set date is through the options markets, and the difference in implied volatility (IVOL) for expiries before and after the election date – i.e. the ‘term structure’.

Reviewing the ‘term structure’ on ASX200 index options, and specifically on ASX200 ATM put option IVOL for the 24 April, 1 May and 8 May expirations, we see IVOL currently priced at 16.9%, 14.2% and 14.4% respectively.

If the options market felt the election outcome could result in increased volatility in the ASX200 or individual equities we’d see far stronger demand to buy puts for the 8 May expiration, which would drive the implied vol higher than the IVOL for the 1 May expiry – which isn’t the case.

FX options tell a similar message that the election – in isolation - is not expected to result in any significant volatility in the AUD. AUDUSD and AUDNZD 1-week implied volatility (expires before the election) is priced at the same levels as 2-week implied vol (expires 2 days after the election).

In essence, there is no evidence from options pricing that traders or market makers see the election as causing lasting volatility in Aussie markets. However, while IVOL can be a solid guide on expected movement it is obviously not always correct, so we still need to be open-minded to potential election-inspired movement in Aussie markets.

The (back of the envelope) Election Playbook

With that in mind, we can break down the most probable election outcomes (priced by betting markets) and how markets may react upon the re-open of trade. This is simple guesstimate, formed without the use of machine learning, and considered without political bias. Naturally, we’d need to consider any influence that would affect the open from Friday’s S&P500 and Aus SPI futures close and news seen through the weekend.

• ALP ≥ 76 seats+ (betting markets imply a 45% probability of this outcome) - An outright win for Labor represents the status quo and should see the ASX200 opening +0.7% to 1% higher, with relief buying seen in the banks, REITS, construction and retail stocks. AUDUSD likely gains 20+ pips on open.

• ALP hold between 71 to 75 seats (33% probability) – the reaction in markets will depend on the total seats won by the ALP and the closer to 76 the more positive the market reaction. Anthony Albanese will need to secure up to 5 Independent votes to form a minority govt, this will require concessions and increased spending commitments, but the market will see this as manageable and feel comfortable that legislation should still pass. ASX200 +0.2% to +0.5%, AUDUSD unchanged.

• ALP hold between 66 to 70 seats (14% probability) – this outcome becomes messy for markets to price, as more than 6 or 7 Independents in an ALP-led minority government would require each piece of legislation to be uniquely negotiated and reworked resulting in possible lengthy delays. There would also be some concern about a blowout in the deficit, with govt spending set to increase to a level that could also see inflation expectations rise. Increased spending commitments would weigh on the private sector, but also suggest increased govt bond issuance, resulting in higher bond yields. The ASX200 likely opens -0.3% to -0.5%. AUDUSD little changed.

• ALP ≤ 65 seats (less than 10% probability) – This outcome would mean Anthony Albanese has to negotiate with both the Independents and even the Greens in exchange for guarantees of supply and confidence. Albo has detailed that he would not negotiate with the Greens, but mathematically to get to 76 seats, he may need to. The Greens Leader Adam Bandt has made it clear he would demand an overhaul negative gearing, the capital gains tax discount and rent caps at the negotiation table. If there were signs that a deal with the Greens could be on the cards, markets would become very nervous and de-risk - with concerns about a re-run of 2010, with governing and the passing of legislation set to become highly dysfunctional. There will be increased concerns that future budgets will fail, or need to be radically reworked, and the rate of govt spending could also fall. Conditional on the market’s view on the prospect of the Greens joining a minority govt – which may not be clear by the Monday open (on 5 May) - the ASX200 opens 0.5% to 1% lower. AUDUSD opens 30-40 pips lower.

If Anthony Albanese can’t form a minority government the Governor General will ask the Coalition to try and form a government (implied at 18% probability). Unless the Coalition obtains 72+ seats, forming a minority govt seems a tough proposition as only 3 Independents (Bob Katter, Dai Le, and Russell Broadbent) seem receptive to coming to the table with Peter Dutton. The risk of new elections would therefore be high. ASX200 and AUD unchanged.

Summary

The Australian Federal election is clearly not the volatility event seen in past US elections, or in other developed countries. The key policies from both the ALP and LNP seem fairly aligned and while there are differences, neither party has campaigned on any radical policies and are both committed to spending and show little interest in major tax reform or budget repair. However, markets always want certainly, so any outcome that increases the risk of a dysfunctional govt and that ultimately leads to reduced or far higher spending, and we could feasibly see volatility in the ASX200, with tactical traders looking to trade the potential underperformance of the ASX200 vs other global indices through long/short strategies.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.