A Refreshed View on Innovation Fuels US Tech Rally Amid Aus CPI and US Earnings Watch

With a number of well-traded megacap tech names due to report earnings in the Thursday and Friday after market sessions, the pullback that was presented to the world yesterday was seemingly there for buying, and the volatility spike we saw yesterday in AI single stock names was there for selling.

Nvidia fires back although near-term volatility risk remains elevated

Nvidia (+7.9%) continues to garner solid client interest and remains at the epicentre of the broader equity market focus. Volumes remain high with 594m shares traded, as well as some 16.9m options contracts traded – the most since June. From a price perspective, shares traded lower to $116.25 on open, with the buyers soon stepping in and driving price to a session high of $128.00. The buying flow was given additional legs with options volatility (vol) sellers taking NVDA 1-month put implied vol from 74% to 62% - a solid reduction in vol, but still elevated enough to suggest that options traders still see near-term risk and are happy to pay up for near-term downside protection.

The NVDA bulls will naturally be pleased the share price is higher on the day, and the push back above the 200-day MA won’t disappoint either – for me, the real kicker though would be a push above $128.40 (yesterday’s high price), which would increase the prospect of price running further to close the gap into $141.88.

Gains have also been seen in Meta (+2.2%), with the technical set-up looking red hot and traders are running this hot into tomorrow’s earnings release. The fact that Meta’s price has run so hard does sufficiently raise the bar to please the market and they will need to blow the lights out to keep the dream alive.

Apple works well on the day, and while the technical set-up is less convincing that Meta, a 3.7% gain on the day will always be taken well by shareholders and is adding points to the NAS100 and S&P500. Microsoft, Amazon and Alphabet also find buyers, as does Tesla (+0.2%), with traders a touch more cautious about going too hard ahead of the upcoming after-market earnings announcement. Put our Tesla 24hr CFDs on the radar, as volatility from it's earnings looks likely, with the options market implying a -/+7.4% move on the day.

Tech and Communication Services (Meta & Googl) aside, breadth has been poor with 70% of S&P500 stocks lower on the day – a narrative that the bears will be pushing, although while rotation (among S&P500 sectors and styles) is still the prevalent theme, to see correlations really rise towards 1 and for a blanket sell-off, with traders selling both tech/Mag7 and value, we would need to see something new emerge and a real shock to the system.

The FOMC & BoC meetings in focus

Earnings aside, we look ahead to today’s FOMC and BoC meetings, with the Fed firmly expected to leave rates unchanged, while the BoC will almost certainly cut rates by 25bp and to signal a more gradual approach to easing going forward. Traders have re-engaged with USD longs into the Fed meeting, although that flow has been driven by comments made by Trump towards universal tariffs than trader’s sensing USD upside risk from the Fed meeting, which is expected to be a low vol event.

USDJPY longs have been the play on the day in G10 FX, although the daily set-up still needs work to really convince and in the absence on any major moves (on the day) in the US Treasury market, USDJPY may see choppy price action through Asia and into the Fed.

AUS Q4 CPI offering intraday AUD volatility risk

AUDUSD has been well traded from the short-side and for those running AUD exposures there is a need to be vigilant to the risk at play from today's (11:30 AEDT) Aus Q4 CPI release. The median estimate for trimmed mean CPI to come in at 0.6% q/q, and I would argue that if the RBA are to skew a heavier consideration on the inflation side of its dual mandate (over full employment) that today’s Q4 CPI print offers sizeable intraday risk.

By way of a simplistic playbook, my thinking is that a quarter-on-quarter trimmed mean CPI print at or above 0.7% would greatly increase the prospect of the RBA keeping rates on hold in February. Conversely, a CPI print at or below 0.5% would validate the current market pricing and would compel the RBA to cut rates by 25bp on 18 Feb, and by way of a risk management exercise.

With the swaps market implying an 79% chance that the RBA cut rates by 25bp on 18 Feb, and with the broad FX community holding a punchy AUD net short position, I would also argue that we should see a far more pronounced upside move in the AUD on a hotter CPI print, than a down move stemming from a below consensus CPI print. That said, trading over news is never something I would actively promote, and my preference on the day is to sell into rallies into 0.6300.

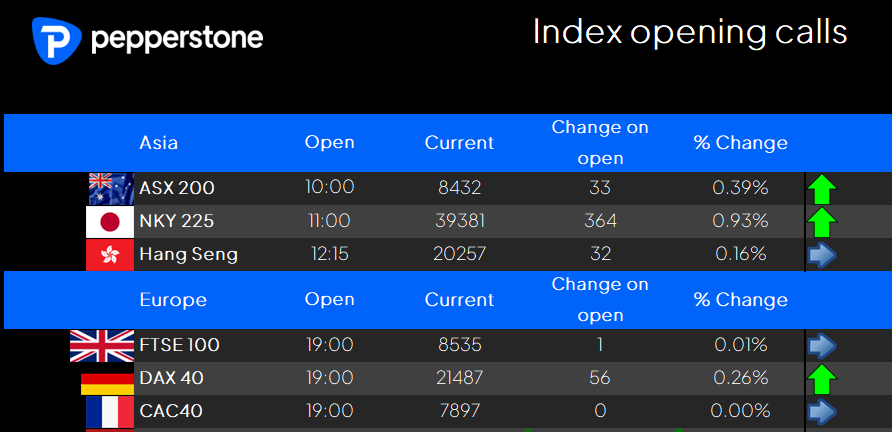

Asia equity opening calls

Turning to the Asia open, our calls are looking somewhat constructive with the NKY225 set to outperform as it takes in the tailwinds from the upbeat NAS100 move. The ASX200 should open on the front foot, and while we won’t get the same boost from tech stocks that the S&P500 or NKY225 sees, crude, gold, copper and iron ore futures are all higher, so this may support resource plays. That said, BHP’s ADR sits -1.4%, suggesting materials plays may take a backseat, even if commodity prices are modestly higher.

With AUS Q4 CPI in play, naturally banks, consumer plays and other interest rate sensitive equities will be front and centre as we head towards the 11:30 AEDT release.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.