Risk-Off Sentiment Intensifies – Traders Question the Prospect of Capitulation

Risk aversion is the play here, and for the most part, we saw a classic day of de-grossing portfolio risk, shorting lower-quality assets and seeking protection through Treasuries, and (options) volatility. A late session rally in US equity futures was a small win for the remaining bulls but given the extent of the one-way flow through US equity cash trade, the turn was hardly convincing and may just offer the sellers exit liquidity.

Some will also point to the fact that 30% of S&P500 stocks closed higher, so there were some pockets of life in the equity market, and it wasn’t an all-out blanket liquidation of equity – but this may be a case of trying too hard to find the positives in a troubled market.

Whether we’re closer to a point where much of the forced selling is reaching an endpoint is a debate on the floors, but aside from the ‘unconvincing’ 1% late session bounce, the intraday tape of NAS100 or S&P500 futures certainly doesn’t offer the sort of conviction to really believe we’re nearing a capitulation point.

What is the Circuit Breaker?

Many will start to opine market on a likely circuit breaker that swings sentiment – this is typically reviewed from a response from the Fed - however, unless the Fed adopt a far more forward-looking approach, US economics are not in a place which offers a more radical response from the Fed, and Trump is certainly not giving any indications he is going to cave to market moves – so, while we can’t rule out strong intraday rallies in risk, with uncertainty increasing, questions left firmly unanswered and the technicals looking wholly bearish, it seems the probabilities for the direction of travel in risk remains skewed.

It’s in this dynamic where the technicals and price action should matter to all. We’re trading the collective flows in the market, and the aggregation of all beliefs – many of which are turning increasingly emotional and even irrational - and standing in the way of this flow of capital and attempting to time a turn without the price action giving you that confidence just increases the risk of ruin.

Playing Defence through Volatility and Treasuries

S&P500 1-week implied has risen sharply to 27.8%, and eyes the spike high of 32% seen in August 2024, and the VIX index rising to 28% - while equity implied vol is shy of extreme reads, the volatility risk premium is rising to such levels that things change in markets and our trading environment needs to be managed accordingly – top of book liquidity thins out, which only exacerbates movement, correlation between equities and asset classes moves towards one, and a higher realised vol sees the volatility targeting funds take down equity risk even further.

Emotional and irrational trading also increases, and for those trading a discretionary system needs to be skilfully managed.

The safety of US Treasuries has been a comfort for many, with the Treasury curve moving lower (in yield) almost in parallel. The 10bp decline in the 2yr Treasury speaks to an increased anticipation that the Fed will need to come to the party sooner and more intently, with US swaps now pricing 80bp of implied rate cuts by December, while terminal Fed pricing has added an additional 12bp of cuts to trade at 3.44%. Inflation expectations have pulled 4bp lower, and high yield credit CDX +14bp.

Crude trades -1.6% and continues to eye multi-year support levels at $65, and while some will see the reduction in the crude price as a positive (for the consumer), the message we’re hearing from the energy markets is certainly not a positive one. Clearly the market is struggling to reconcile the notion of OPEC+ increasing supply in April and slower US economic activity.

Gold and the USD Fail to Perform

Despite the Higher Volatility Gold has failed to play defence in the portfolio and trades -0.7%, and we see broad selling flows through US trade, with spot gold pulled from $2910 to $2880. G10 FX moves have been relatively contained, with the USD finding modest buyers vs the CAD, AUD and GBP. As we know, historically the USD outperforms when we get a solid rise in volatility, but when the US economy and US equity market is the central point of concern this is now limiting the attractiveness of the USD. Interestingly, we’re not seeing any major love for the CHF and JPY either, which is making life for the tactical FX players a touch more problematic.

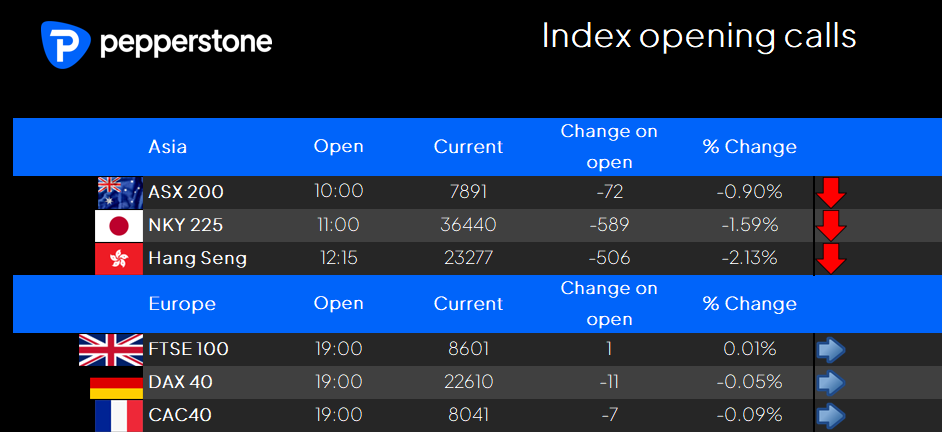

Turning to Asia, where our calls for the respective cash equity opens are unsurprisingly heavy, with the HK50 eyed -2.1%, with the selling building on the -1.9% selloff seen yesterday. The ASX200 should outperform Asia, as is typically the way given its characteristics as a more value-oriented equity index, but even so, SPI futures trade -70p and we see the cash index unwinding below 7900. The risk of another session where utilities and the ultra-safe end of town in vogue is high.

Traders will navigate the US NFIB small business optimism survey (21:00 AEDT), which presumably gets a greater focus given the unfolding economic concerns and a strong reduction in sentiment would presumably add fuel to this fire.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.