With US equity futures, crypto, and crude rallying firmly off session lows, amid strong selling in US Treasuries, I'd argue what played out was more in fitting with a bear market rally and one that traders should look to fade, rather than believing we’ve reached a key inflection point for a sustained trend higher.

Naturally, one must have an open mind to all possibilities and the prospect that the lows have been seen in equity. The price is the price and the only opinion that matters – but if we are really going to climb the wall of worry, one could argue that Trump threats to add an additional 50% tariff on China, if they don’t back down today on its 34% tariff hike, should, in theory, be a clear negative for risk and should heighten the wall that the market needs to climb.

EU leaders have not given us much to work with and we should learn more in the session ahead. EU leaders did offer Trump concessions proposing zero tariffs on autos and industrial goods, but Trump demands they drop the 19% VAT rate, and that will be a tough proposition to find a consensus position with the European's ranks. Making the situation somewhat more convoluted, the EU slapped a 25% tariff on US steel and aluminum imports.

S&P500 and NAS100 futures spiked 8.6% and 10.1% respectively shortly into US equity cash trade on the back of fake news that the White House was planning a 90-day delay on tariffs. Essentially, this highlights the positive effect on markets if we were to see a delay materialise at some stage. The fact that markets then only retraced 50-60% of the rally when it became clear that reports of a delay were indeed fake suggests some still see a delay as possible. However, the greater near-term consideration should fall on what EU leaders decide on its VAT rates, and how China now responds to having 100%+ tariff rates on exports to the US.

Most see a low probability that China will fold on its 34% tariff countermeasure, so we assume a high risk that Trump will follow through with an additional 50% tariff rate. Close inspection subsequently falls on USDCNY and USDCNH, and the potential for China to offset the tariff effects through currency depreciation. Of course, China is not going to publicly declare a stance for a sustained CNY depreciation, as this would only encourage capital outflows from China at a time when Xi et al require the capital to remain in China for the fiscal stimulus measures to work efficiently – but a grind higher in USDCNH now seems a strong possibility – a factor which could further weigh on the China FX proxies (AUD and NZD for example) and keep G10 FX volatility elevated.

The fact that S&P500 1-week ATM implied volatility still resides at 58%, and the VIX index at 46%, while US high yield credit took no part in the intraday risk melt-up suggests the move from the lows in US equity was driven by positioning and not by investors feeling we’ve hit a key inflection point. We also continue to see big dislocations between the market pricing for implied central bank easing and what is heard in communications from Fed officials and other central bankers, and while rate cuts will only soften the blow on households and businesses, rate cuts are not the panacea for a sustained rally in risk.

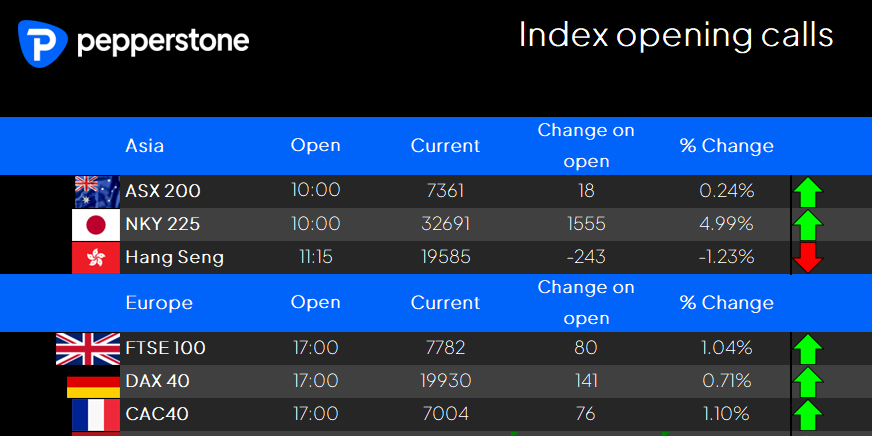

Our calls for the Asia equity open appear mixed, with strong gains expected in the NKY225, a flat read for the ASX200, while the HK50 is set to unwind 1% lower. With S&P500 futures -4% at the time of yesterday’s Asia equity close, the intraday rally from that point puts S&P500 futures 4% higher – so, despite a largely unchanged read in US cash equity indices, the net change in equity futures was far better than feared. The opening calls also suggest forced selling and liquidations will be less prevalent, which could reduce the volatility seen on open – and we watch and potentially react to the price action after the pre-market orders have been filled, as where prices go from these could be telling.

I remain sceptical about the upside to risk, but what the market does in the short term could be wholly different.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.