US Assets Slide, Volatility and Safe Havens Soar Amid Tariff Fallout

A focus on the floors has been on headlines that China’s tariff rate is not 125% but adjusting for the 20% fentanyl tariff we understand the real level to be 145% - assuming there is no marked decline in Chinese exports (which there will be) the math checks out that the US effective tariff rate is closer to 25%. That rate is hardly a positive for US risk, and while there is some distant hope that China may look to reduce tariff rates on certain US goods, and Trump and Xi will break bread at some stage, the fact that USDCNH is trading weaker on the session is telling.

In markets, S&P500 futures were rolling over and headed lower through late Asia and into EU trade, and while we questioned if this was perhaps driven by fast money accounts cutting back and locking in a solid 8-10% gain after the tariff pause headline rip, the move lower gained momentum into US trade, with S&P500 futures hitting a low of 5146, before the buyers stepped up. The S&P500 cash closed -3.5%, and while off the session lows, it was a tough day for nearly all S&P500 sectors, with money managers seeing some attractions to rotate and hide out in staples and utilities plays.

We’re back watching the US 30-yr Treasury, where despite a solid $22b Treasury auction, the buyers have stepped aside and the sellers driving the yield +13bp and at 4.86% eyes a re-test of all-important 5% level, where an upside break will likely get headlines and perpetuate market concerns. US core CPI was lower-than-expected, and along with continued US growth concerns, saw US 2yr Treasuries rally on the day – importantly, we’ve seen US inflation expectations (aka 'breakevens') falling hard, resulting in an outsized rise in US real rates (i.e. US Treasuries adjusted for expected inflation). US 30-year real yields are now at 2.7% and the highest levels since Dec 2008… Think of US real rates as the real or true cost of capital, and in an economy that is slowing, real rates that are rising will only further weigh on economic activity, smack the mortgage market and limit corporate investment and expansion plans.

Demand for equity volatility was evident on the move lower in US equity, with the VIX index rising 7 vols to 40.7%, and the S&P500 1-week ATM implied vol +14 vols to 48%. This level of implied volatility equates to an implied move in the S&P500 of -/+3% on average over the coming week, which seems fair given S&P500 10-day realised volatility is an eye-watering 71% and given the run of outsized close-to-close % changes.

US Treasuries offer very little protection for investors, with the classic 60/40 portfolio impacted as both equity and bonds trade lower on the day. What has offered an efficient hedge for risk is volatility, gold, CHF and JPY. The demand for gold has been insatiable with both spot gold and gold futures seeing an out-and-out low-to-high trend day, with huge buying accumulation seen in futures on any intraday pullbacks. In FX markets, the ‘Swissy’ reigns supreme, with USDCHF breaking to new run lows, and the weakest levels since the SNB pulled the 1.2000 floor on EURCHF in 2015. Rallies in USDCHF will likely be limited with traders quick to sell into strength – USDJPY has a similar feel, with the spot rate closing below the consolidation lows of 145.25… happy to follow USDJPY lower and chase the downside.

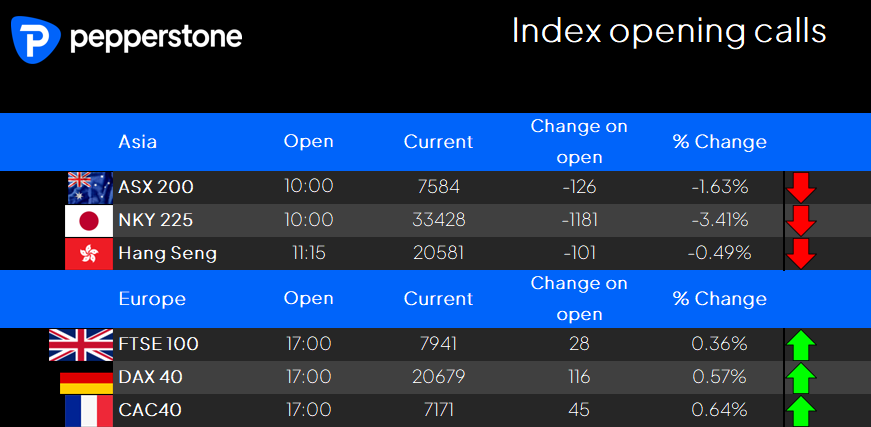

Asia will feed off the moves in US equity, with both the NKY225 and ASX200 set to run into the final trading session of the week with a tough open and with heavy selling expected. For those wanting to remain positioned in equity the idea of rotating into the safety of staples and utilities is there, with energy, tech and materials plays set to underperform.

By way of event risks to manage, we watch for headlines from China on anything tariff-related, as well as the CNY fixing, while traders look ahead to the US and PPI inflation and the University of Michigan survey and just how bad the reading could be. We also see the formal start to US earnings season, with JP Morgan, Morgan Stanley, Wells Fargo, and Blackrock reporting numbers.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.