Analysis

While we’ve seen close 14,000 Bitcoin futures contracts traded, which is huge.

For those still in long Crypto positions, the possibility of a re-run of this sort of movement in the coming 48 hours is a critical consideration, while the bulls are making the claim that the liquidation has now played out. Consider the high-to-low percentage range in Ethereum has been 24% - some five times the 5-day average range, while Ripple saw a 31% high to low range – this is clearly home of the brave.

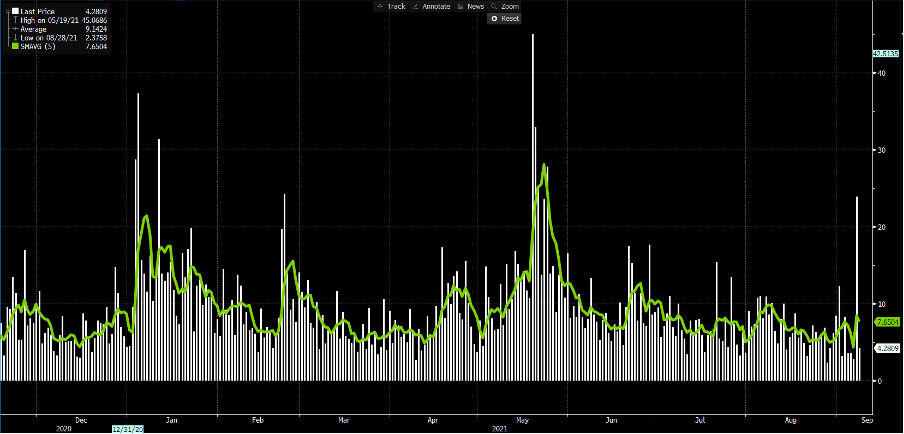

Daily high-low % range

(Source: Bloomberg - Past performance is not indicative of future performance.)

Most are pinning the move seen between 00:30 AEST and 01:10 AEST on news that El Salvador was having technical issues, with President Nayib Bukele first complaining that the Bitcoin app was not available on Apple or Huawei – later taking to Twitter to push the government's Bitcoin app, only for it to struggle with the demand in user registrations.

This seems an odd reason to cause such aggressive moves.

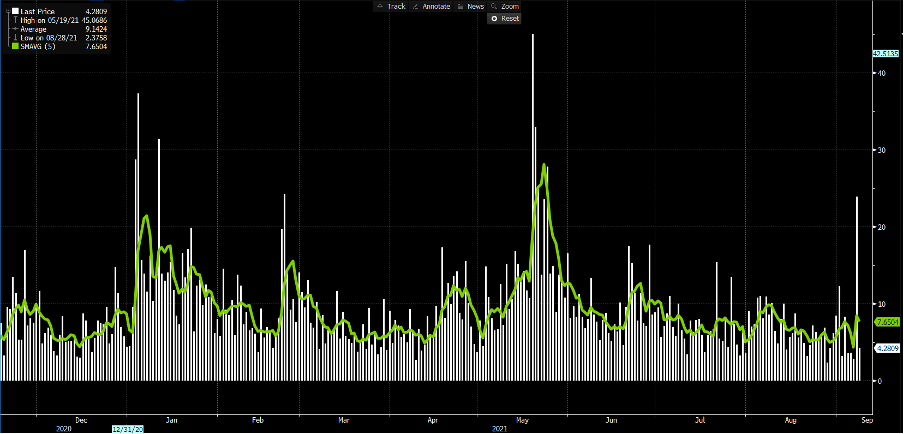

Ethereum intra-day move

(Source: Bloomberg - Past performance is not indicative of future performance.)

There has been some focus on mining difficulty, or the amount of resource needed to mine Bitcoin. The level of ‘difficulty’ has been increasing as miners migrate operations away from China in the wake of the crackdown, and this is having an impact on margins. Miners are the backbone of the project and they will cut back on mining if it’s less profitable to do so - so if the price gravitates towards the cost of production, then it can cause ripples (pun intended) in the market.

Most notably this has been a flow driven move – and when price started to crack the savvy buyers likely sensed the flow, pulled their orders and it wouldn’t have taken much for the price to drop quickly on some sizeable sell orders. The sheer extent of the liquidations going through the market meant as price rolled over-leveraged longs and other players would have taken a loss and it all aggregated into a one-way move.

We also need to consider the extent of the bullish moves since July – perhaps in anticipation of El Salvadore adopting Bitcoin as legal tender, but there are obviously other reasons. Just taking a few coins for example, Bitcoin had rallied 80%, Ethereum 130% and Ripple 175% - so this was a market that was perhaps overloved in the short-term.

Could it also be that the liquidity beneficiaries – which could include crypto – may be sensing more normalised future policy setting from major central banks – perhaps higher real rates could become a headwind? Crypto is a momentum vehicle after all and when that momentum is challenged it pays to be closest to the exit when the fire breaks out. As we see from spikes in the trading range fires do happen periodically. The question Crypto traders now face is the possibility of another liquidity inspired volatility move, or has this provided an attractive opportunity to get set for another move higher?

As always in this environment it pays to truly understanding one’s risk and correct position sizing is critical – but the increased volatility and premise for rapid potential profits is certainly a clear drawcard for those who can harness the vol.

(Source: Bloomberg - Past performance is not indicative of future performance.)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.